The Allstate Transaction

Eight Illinois-domiciled members of the Allstate group underwrote auto liability policies in Michigan and were members of the Michigan Catastrophic Claims Association. On February 2, 2021, they each filed a plan of division with the Department in order to effect a transition of certain specified inactive policies with outstanding claims into eight New Companies which would then merge into three Resulting Companies, one of which would reinsure the other two. They also made requisite filings with the Michigan Department of Insurance and Financial Services and requested a hearing.

The Department retained outside practitioners experienced in legacy transactions, including a project manager (Luann Petrellis), an independent consulting actuarial expert (Risk & Regulatory Consulting), and legal counsel (DLA Piper LLP (US)) to assist. This team and Department staff (under the leadership of Chief Dep. Dir. Shannon Whalen) expended more than 2000 hours on the evaluation of preliminary filings, drafts of the final versions of the division applications (relying upon the Department’s existing analysis and examination processes), as well as developing division best practices and repeatable processes. The Acting Director also appointed a retired Illinois Appellate Court Justice and former Circuit Court (trial) Judge, May Anne Mason, to serve as hearing officer.

Meanwhile, counsel for the Applicants and in-house counsel at Allstate worked virtually around the clock for months to develop all of the transactional documents and regulatory filings necessary to effectuate the transaction.

Pre-Hearing Preparation

The Applicants and the Department jointly (but at arms’ length) developed a procedure for notice, comment and hearing, as well as a communication plan for sending written notice to each policyholder and each person with an outstanding claim under the specified policies and for publishing notice in Illinois and Michigan newspapers of general circulation. Notice also was provided to the Illinois and Michigan guaranty funds, the National Conference of Insurance Guaranty Funds, and the Michigan Catastrophic Claims Association (MCCA). The notices provided background information on the proposed division, included contact information for the Department, and advised of the right to appear, object, and/or intervene in the hearing.

Due to the COVID-19 pandemic, counsel for the Applicants and the Department worked cooperatively (at arms’ length) to prepare for a virtual hearing. They developed a Stipulated Virtual Hearing Protocol, the Applicants retained FTI to facilitate and manage the hearing, and the Department posted all non-confidential transaction-related material on its website.

Pre-hearing status conferences with the Hearing Officer resulted in the Applicants submitting pre-filed testimony, along with a jointly developed list of exhibits. The Applicants and the Department also submitted Proposed Findings, Conclusions of Law, and Recommendations to the Hearing Officer.

No objections or petitions to intervene were filed.

The Hearing

Justice Mason opened the hearing at 9 a.m. on March 3, 2021. A court reporter recorded welcoming remarks by Department COO Kevin Fry[6] and the Hearing Officer’s preliminary remarks setting the agenda for the hearing. In addition to the parties, their representatives, and witnesses, a number of participants identifying themselves as members of the public appeared for the Hearing, including lawyers, regulators, guaranty association representatives, and experienced legacy transaction counterparties.

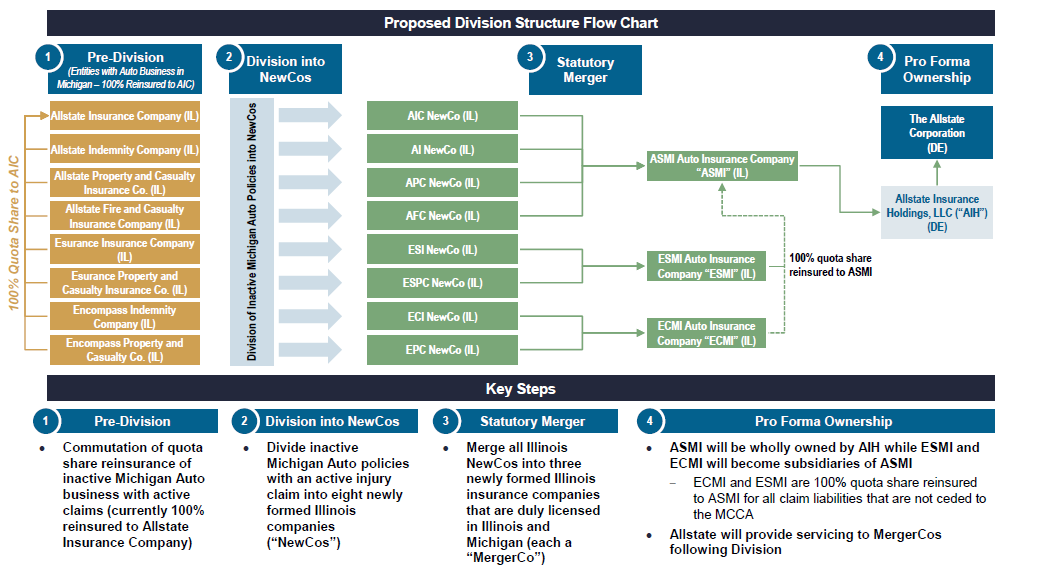

Allstate made an opening statement, and then presented live testimony from Allstate SVP and Treasurer Michael Padraja. He summarized the business reasons for the division and described the four main transaction steps:

(1) commutation of the existing reinsurance relationship between Allstate Insurance Company and the Dividing Companies;

(2) division of each of the Dividing Companies into Surviving and New Companies and allocation of assets, liabilities including MCCA obligations), contracts, and required surplus to each;

(3) simultaneous merger of the eight New Companies into the three Merger Companies (representing three main brands of Allstate, Encompass, and Esurance), and the passing to the New Companies by operation of law of allocated assets, liabilities, contracts, and required surplus; and

(4) 100% cession from two of the Merger Companies of their insurance liabilities to the third.

The following diagram depicts the various steps of the proposed restructuring:

Figure A:

The Applicants also presented live testimony from independent financial expert Joseph Cassanelli, Managing Director and Co-Head, Financial Institutions (North America) for Lazard, Frères & Co. LLC, who testified to the fairness of the transaction and satisfaction of the financial requirements of the Division Law. The Department cross examined both witnesses.

The Department then presented its opening statement and live testimony from Chief Dep. Dir. Whalen. She explained that the Department focused significant analysis on the Merger Companies. She also described information that the Department considered important: (i) claims would continue to be managed by the same Allstate entity; (ii) the Merger Companies would become parties to existing Allstate intercompany agreements (investment management, service and expense, tax sharing, and tax settlement); and (iii) the Merger Companies could not pay dividends to its shareholders for five years without Director approval. She also described the Department’s evaluation of the adequacy of the New Companies’ loss and LAE reserves and initial capital, the four transaction steps described above, and the protection of (and lack of adverse impact on) policyholders and claimants.

At the close of the evidentiary portion of the Hearing, the Hearing Officer afforded members of the public attending the Hearing, either online or by telephone, the opportunity to raise objections, make comments, or ask questions. No one indicated that they wished to be heard. After hearing closing arguments from counsel, the Hearing was closed and the Applicants’ request that the Hearing Officer recommend approval of the Plans of Division to the Director was taken under advisement.

Approval

In her Findings, Conclusions and Recommendations, the Hearing Officer summarized the applicable statutory requirements and the evidence establishing the Applicants’ satisfaction of them. In particular, she found no evidence of a violation of the Uniform Fraudulent Transfer Act; i.e., (i) that the allocation of assets and liabilities was not made with intent to hinder, delay, or defraud any creditor; (ii) the assets would not be unreasonably small in the relation to the Resulting Companies’ business; (iii) the Resulting Companies did not intend to incur debts beyond their ability to pay as such debts come due; and (iv) the Resulting Companies would not be or become insolvent upon finalization of the transactions.

The Hearing Officer concluded that timely, good, sufficient and appropriate notice and an opportunity to be heard had been provided; due process had been accorded to all; the Director and the Hearing Officer had subject matter and personal jurisdiction over the parties, policyholders, and claimants; all requirements had been satisfied to effect a transition by operation of law of all assets, liabilities, and contracts associated with the Specified Policies; and treatment of the Merger Companies as the “original insurers” of the Specified Policies would apply to all contractual rights, obligations, and liabilities, and ensure seamless application of regulatory law.

On March 5, 2021, on these bases, the Hearing Officer further concluded that the plans comport and comply with the statutory requirements and recommended that the Director approve the plans and enter an order consistent with such bases. The Director did so by Final Orders dated March 19 and 31, 2021, conditioned upon execution of the plans according to their terms, conditions, and covenants; receipt by the Department of all specified material and information; and receipt from the Michigan DIFS of the requisite licenses to transaction the business of insurance in Michigan.

Observations

Many insurers operating in the US support insurance business divisions or transfers. Some lines of legacy business will continue challenge regulators for decades and may benefit from the broad resolution flexibility that insurance business division and transfer are intended to provide. Guaranty associations have challenged certain iterations of resulting legislation, and regulators have focused appropriate attention on the issues. Long-term care insurance is the latest line of insurance in need of a long-term solution and may well benefit from business division. Pricing and reserving practices appear to have sufficiently evolved to cover the underlying liabilities. We could well be in the advent of significant transactional activity. We encourage legacy business practitioners to study the Allstate transaction as one form of successful business division model.

As demonstrated above, the Illinois Division Law proved to be a nimble regulatory apparatus for legacy transactions. While there could be many reasons for the lack of objections, it appears that the many knowledgeable observers of the hearing concluded that appropriate regulatory oversight by experienced professionals had been exercised in respect of a well-known and trusted insurer group.